Small Acorns

An accidental success. You can do this if you choose.

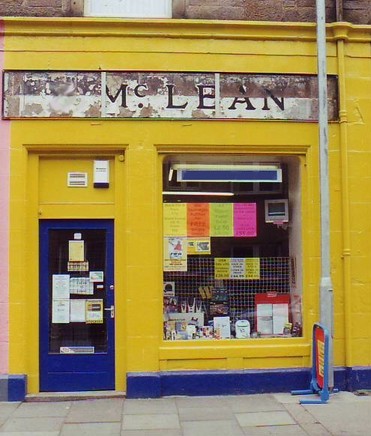

One of Our First Empty Shops Bought In This High Street

(c) 2000 Argyll Group plc & Scotslion Collection

Before the paint (in the client’s preferred colours) these are the next door pair of shops and what the first shop looked like after laying in a dilapidated state for several years…

^^ SHOPS BEFORE RENOVATION ^^

This first shop grew like the provebial acorn. It soon became three shops being purchased. They ere incredibly good value for money (revealed later). Like some form or real-world Monopoly game. It was almost mandatory as all three were is a shocking state and at the main end of the High Street which let the whole place down.

Here is what they looked like after being thoroughly cleaned and renovated. Finally with a lick of decent paint and ended up being rented very quickly. The rental level might also surprise you (revealed furth down this page)…

^^ SHOPS AFTER RENOVATION ^^

What do you reckon? Better? Worse?

This page – Small Acorns – is actually about the first set of shops we bough in a particular High Street. It could be Anytown, Anywhere. That is one of the main themes for this website. One which we are passionate about and would like others to consider replicating in order to get their own High Street back to life.

=> Just for fun, have a guess how much that shops, picture above, cost to buy? We will reveal the price later on, in the article on this page.

The body of work covered within this website spans the past 30 years. It has brought 46 closed-down buildings back yo life and created 178 new jobs. Not a bad accidental success.

There has to be a better way than just letting empty shops rot away.

=> We found that a few good friends joining together can bring High Sreets back to life. Buy and renovate a shop (no mortgage needed). Then help the newstart tenant: sometimes with seedcorn money as banks don’t lend to new companies readily.

There is a bonus too…

=> All shareholders got far better returns on the funds in each shop than the banks gave on savings. The money was asset-backed and secure as we have an inviolate rule that mortgages are banned on all of our buildings.

Best of all for the High Street is that our rents were/are at least 25% less than other similar shops.

Why? Because we had accidentally cut the banks out of the equation. As a result, everybody wins (except the banks – time to get the world’s smallest violin out).

The virtuous circle of high return on savings and low rents on shops became so obvious, that our managing director asked a local bank manager about it. “Why do banks not lend to newstart businesses that want to bring shops to life ~ it seems like a goo business to be in?”. The answer: “Oh its Head office rules!”

So the boss went and bought a closed bank building and made a point to the bank’s Head Office. It was bliss. Have you ever been turned down for a bank loan, or gotten fed up with a bank?

In the town that this page relates to, the beautiful stone built bank building had been closed down and the bank branch moved into a cheaper, smaller, former butchers shop (ironic). When we bought the big bank building, the result was very interesting. The point was also well made to the bank as they saw the results as the bank balance increased (to the banks cost). Banking karma. Delicious.

Two decades later and over forty shops in this specific group of shareholders, plus 178 new jobs and that represents a body of work with heft. It is reasonable to make a case that…

High Streets do not need to die.

***********

Some Good Luck Can Help Too

To clarify how this whole enterprise came about, we need to mention some initial seed~corn money. This was obtained from the sale of a building which we tried to renovate at the Mull of Kintyre – our original purchase was the Keil Hotel…

This Large Building Isn’t The Literal Acorn

Photo (c) Argyll Group plc

This hotel released funds after our purchase and resale of the building in the photograph. These profits then helped start this whole Real Dragons’ Den adventure. It is fair to say that the £76,000 profit from this poor old hotel was the catalyst that funded the refurbishment of many closed down shops and created a lot of new jobs during the following decades.

The first project at the Keil Hotel was renovated with our own funds: Three friends put £8,000 their own money to buy the large derelict building pictured above for a bargain £24,000 freehold.

=> Ever since the first project we have worked with 100% equity and a prohibition on any bank finance. We would strongly recommend others consider this element of the business model too.

All in all for this page, perhaps not quite the small acorn that comes to mind. After buying that small closed-down shop, pictured at the top of this page and comparing it to the massive Keil Hotel building, the latter is not a small project.

We banged our proverbial heads on well financed “Enterprise Agency” doors as a significant grant has been promised to whoever renovated and re-opened the Keil Hotel.

All of our overtures for help to get the local economy back on its feet got knocked back time after time. So we ended up saying “enough”. The tragedy is we had a whole floor of that remote hotel partly pre-let as a telephone call centre to a major London plc, with a second floor ready to sign off with another tenant. Many jobs were lost because local enterprise agency couldn’t get their act together. We even tried the banks, but they were as useful as a chocolate teapot.

Seaview From The Top of The Keil Hotel

Photo (c) Argyll Group plc

Please remember, the Keil Hotel is very remote. It is on the Mull of Kintyre, far away from pretty much anywhere. So jobs there are important. So too is the local amenity value of a big hotel.

After several knoc-baks and a mountain of frustration, one of our shareholder frieds in the Keil Hote renovation group said…

“Enough of this, let’s just see if we can resell the Keil Hotel and move these efforts to a council area where they care about new jobs and getting High Streets brought back yo life.”.

What we hadn’t expected was that with some decent marketing, and we had a good team on side, the old hotel went for four times what our group bought it for!

The three friends became very good friends! The third musketeer used his lump sum to buy several small acorns. Shops. All closed, and slowly, one by one, year by year each was refurbished and various tenants helped in getting a new business started.

=> So when we quote 46 shops being bought + renovated + re-opened and 178 new jobs being created, that does NOT include what our freinds go on to hieve on their own project portfolios.

The latest overall count is 98 renovated shops + hotels + industrial units + factories and 404 new jobs in the overall total.

If we can help you to get your High Street looking healthier, please feel free to get in touch (click here).

Part of The Old, Closed Bank. Now A Thriving Small Business

The picture is just one of 46 buildings re-opened: so far. This is a hobby gone wrong – in a good way. Just a few friends who decided to have a small property adventure. One empty shop reopening at a time. If we can do this, how about you? It is very enjoyable.

During the derelict hotel experience in 1999, there was there was a town meeting about the issue of there being so many empty shops in the area. This was, and still is, a typical problem. Closed shops blighting the High Street of Anytown, UK.

In 2018 keeping small shops from going out of business is still an important topic.

The No Entry Sign Is Metaphor For How Banks Treat Small Business

The shop? Just one of 46 buildings our group of friends bought, refurbished and resold.

To put numbers on the earlier point about keeping rents affordable, in 1999 that meant £12 per week for a shop. This handed a new business breathing space to become established without overly high rent, nor high overdraft charges as we provided a modest line of credit to each business where needed.

Back in 1999, some 600 local townsfolk braved a bitterly cold January night to attend a public meeting in this particular town, in an effort to address the problem of closed down shops and other problems blighting a fragile rural economy. The powers that be on the stage said this was the “Tesco Effect”, that small shops which were no longer viable since Tesco opened a superstore nearby. These once vibrant main street shops would need to be converted into flats.

A paw from one of this website’s founding subscribers went into the air and asked the question…

“With shops being so cheap and young folk leaving the town to seek employment in the city hundreds of miles away, would it not be possible for government agencies funded to help revitalise fragile economies, to reopen those small shops and create jobs to stop youngsters having to leave ?”

The response was depressingly predictable from the local council officials. Those on stage who tried the “it’ll not work” guff were almost booed off and had miserable scowls on their faces said it all.

In order to make a physical demonstration, and with some of the spare cash left over from the derelict hotel sale, the first empty shop in this town was was bought. Around £7,000 for the building with £2,000 on a very modest refurbishment (this was still the 1990s). Enabling us to keep the rent very low at £12 per week (6.9% return on the group’s money). We looked everywhere for the “before” photo as it really does show how run down this poor closed building was. The nearest we managed is the picture at the top of this page. But with the first coat of paint already applied. By the way it was our tenant who chose the bright yellow theme!

The “after” photo of this shop – and the next two we bought in this part of town are here…

The old signage was yet to be finished off at the time of this photograph, but it does give an indication of some progress (pictures of the completed project on the next page).

It is not that hard to get these buildings back into meaningful use. One shop here or there results in a couple of jobs. This might not seem that worthwhile, but over two decade this has totalled 46 shops, industrial units and hotels that have been reopened. Over 178 jobs created and still going strong.

Not one penny of bank finance, nor mortgage and the whole process has been far healthier for the absence of these questionable institutions.

This might seem to be small acorns to many, but these newstart businesses go on to pay rates, taxes VAT, National Insurance, PAYE, Fuel Duty, Insurance Tax – a vast range of money that goes into the NHS, education, police and fire services.

On many days, it can seem like an insurmountable struggle, but time after time we have found this Real Dragons’ Den effort an incredibly enjoyable experience. We would heartily recommend you to consider this sort of venture. As to the hurdles and finance?

Lesson: If the banks give nought but a depressingly familiar “no”, keep on exploring all other financing options. Just keep pressing forward – you will win through in the end.

Please Click Here For The Next Page