Founders’ Credentials

Charity Number #1

Creditcare Debt Survival Charity

Our Research of HM Courts

Revealed 404 People Committed Debt-Suicide in 1996

Nobody should die of debt. Rather than just give some warm words of comfort to his friend’s widow and two teenage children, Russ McLean, the founder of this website and company (Scotslion) thought long and hard about how to remedy this nightmare in a way that could pragmatically help remedy and prevent some of the inexorable future suicides…

=> How to stop people dying from debt.

To be precise, it was with the help of readers from our Unique Property Bulletin publication and several shareholders of our companies Argyll Group plc and Unique Property plc that got this charity started (for regulatory purposes, we would advise both public companies have been taken private).

On 25th March 1997, Russ McLean registered charity number 1061544. Talk Radio in London asked for an interview. Due to a huge number of phone calls, further funds were needed to run the charity, so the offer of a radio station interview was accepted. A radio broadcast helps folk drowning in debt to find money advice charities. Also, anyone who has run a charity will find people donate to causes they prefer: but generally they need to know that those charities exist (hence the radio broadcast).

The first interview with Scott Chisolm resulted in HUNDREDS of enquiries – from people buried in money worries. Our small group of volunteers struggled with the number of people in unmanageable debt.

To help sort out these problems, an efficient way was devised. We quickly wrote this DIY debt survival manual. To our surprise, it did the job…

^^ DIY Debt Survival Manual ^^

The debt survival manual worked well. But we ran out of the first and second 1,000 print runs remarkably fast. So a fresh edition was written in preparation for more folk needing these services. A good amount of fine-tuning was incorporated so that this book worked more intuitively for each client…

^^ DIY Debt Survival Manual ^^

A lifeboat analogy for those drowning in debt.

charity number 1061544

The name Creditcure was changed to Creditcare. This was slightly less inflammatory. By this point, we were getting through to banks and a memorandum of understanding was brought about. One that moved the debt management system (during default) from the British Dickensian penalty (close to debtors prison) and find a more civilised way forward.

Dare we say, something akin the American format. By that we mean for those who try their best at starting a business for example, are not penalised to abject bankruptcy just for making their best effort to do the right thing and create jobs as well as support themselves and their families. Nobody should lose their house and family for that. But it happens and far worse…

***********

Creditcare Money Advice charity number 1061544

Why Start This Charity?

Here is an old photo of this website: Scotslion Ltd., Managing Director and this companies predecessor owner, formerly Argyll Group plc., CEO, Russ McLean taken in 1993…

^^ Russ McLean in 1993 ^^

A friend asked if Russ was chewing a wasp or a cactus given the facial expression.

To avoid misrepresentation, here is a more modern photograph…

^^ Russ McLean in 2023: 30 Years Just Flew By ^^

But not for our friend Terry. He died in 1996.

The “cactus” reference by our friend Terry, is, unfortunately where the humour ends. Out friend had a business based near to London, which is where the “younger” 1993 photo was taken. Sadly, it was our departed friend Terry who took that 1993 photo of Russ. It was at a time when Terry was at a happier time in his life.

We did not know it back between 1993 and 1996…

=> But Russ McLean’s friend Terry was headed towards financial ruin.

=> Within a short while of what was a happy occasion, Russ’ friend had taken his own life.

=> Rather than just offer some warm words of condolence to his friend’s widow and two teenage children, Russ channelled the anger and distress by writing to every Coroner in England and Wales asking how many people take their own lives where debt is a material factor.

=> All of the Procurators Fiscal in Scotland were written to as well ~ the coronial system is slightly different in the north (updated: click here).

=> The answer (in the 1990s using old-school pen and paper) was an appalling 404 debt-suicides each year in the UK.

=> When warm words of condolence do not seem to do justice at a funeral, sometimes it is a fair idea to remedy the actual cause of the tragedy.

=> In this case, the Creditcare Support and Debt Advice Association was registered at the Charity Commission.

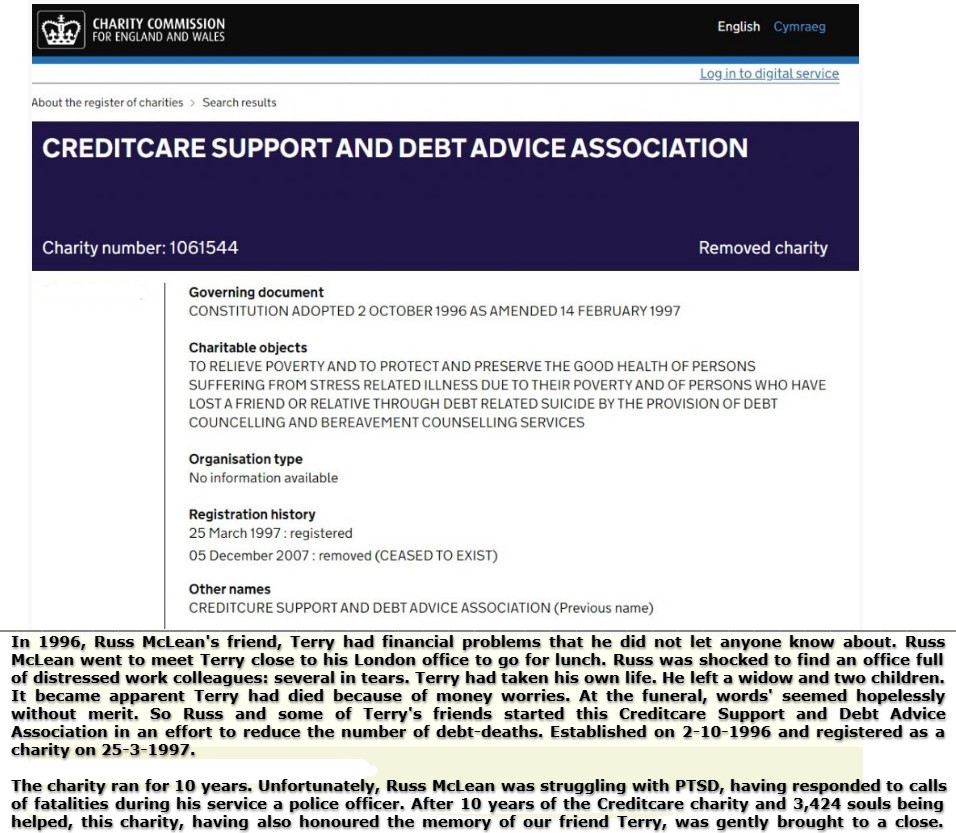

This charity’s aims are covered here in this excerpt from the Charity Commission website…

^^ Excerpt From The Old Charity Commission Website ^^

We closed this charity after 10 years.

“Boom & Bust” economics were ended.

Or so we were told by Gordon Brown.

Creditcare Money Advice charity number 1061544

The team at Scotslion Ltd., and from our earlier Argyll Group plc., and Unique Property Bulletin Ltd., organisations are studiously non-political. But there is an obligation to be reasonably aware of matters surrounding political issues. Especially those, for example, where debt-management are concerned.

=> Since the 1997 General Election we had been asking politicians of all flavours that schools have tuition in how to manage money safely ~ and include that subject of safe money management within their educational curriculum

=> The Coronial Law on “preventing future suicides” is more than a fundamental basic. It is a statutory requirement.

=> All of this should help reduce this appalling and tragic waste of life.

Many years passed. Many cases were resolved.

Then, in 2006 we were advised by local MP Gordon Brown that our request for schools to teach students about money and especially household bills + safe debt-management would be included in their educational syllabus. Curiously before the phrase became common currency, our MP advised that “boom and bust” was going to be a thing of the past. Stability was intended for Gordon Brown’s legacy as Chancellor of the Exchequer (that didn’t age well, which is one reason why we are non-political).

By 2006, we had already noticed a reduction of numbers needing the services of our charity. So the trustees took a decision to gently wind down the charity after it had completed 10 years of use.

=> It was not the done thing at that time (1997 to 2007), but fortunately by the year 2024 (when this page was last updated), it is, with great relief, and an acceptable thing to admit to mental health problems. From his service in uniform, our founder had to attend fatalities that involved children. This conflated with the death of his younger brother (aged 2 and a half years old at death). That was one of the reasons for a lifelong battle with PTSD. Only in 2024 can it be felt safe to admit that PTSD was a factor in the closing of this Money Advice Charity.

The directors and we believe most human beings have a finite ability to absorb so much death and suicide. For several complex reasons surrounding health, the charity had run its course and we had to bring it to an orderly close.

In addition to several thousand folk that had been helped during the lifespan of this charity, and a modest tribute to our friend who had taken his own life, we also learnt an important lesson…

=> It may seem odd, but we now BAN mortgages on our company assets (and the majority of us have reached a healthy point where are own homes have NO mortgages on them)!

This rule has helped remove vast amount of worry and stress.

It is worthy of further study. But for this brief segment relating to the first charity, hopefully our newer readers will appreciate why we are averse to debt in general and for the past 27 years, mortgages are irrevocably off of the menu.

^^ The Angel of Debt ^^

The Observer ran an article in the 1990s.

We weren’t too keen on the title!

Creditcure Money Advice charity number 1061544

***********

Should We Bring Back The Creditcare

Money Advice Charity?

This website is focussing on reducing electricity bills + bringing household budgets back to manageable levels.

Plus the our High Street rescue initiative has brought 46 empty buildings back yo use and 178 new jobs. It was set to be replicated in several towns across the UK until we put that on pause to sort out the fuel-price-crisis.

As we have launched this website as a WORK-IN-PROGRESS so as to stop as many debt-suicides a soon as possible. we would ask YOU if you have a view on this question?

=> Are there enough CAB and money advice charities in the UK or do we need more. Answers please to: Click Here.

Any advice or constructive comment that you send to us is very warmly appreciated.

What has caused us to think again about resurrecting the money advice charity (and drastically increasing the number of branches) is the details from respected money advice journalist and campaigner, Martin Lewis, C.B.E.

We are not sure about you, but this article from Martin put a shudder up our spine…

Full Martin Lewis Article: Click Here

***********

We closed our modest Creditcare Money Advice Charity in 1997. But 16 years later in 2023, we are now looking at whether more of these money advice charities are needed.

Ironically ALL of the good banks we approached in the 1990s were IN FAVOUR of mediation charities.

=> Money advice mediation works. It results in vastly better outcomes foor folk living on the financial edge of decent into unmanageable poverty. It also assists those to whom money is oed to have a fair and trusted measure of AFFORDABLE repayment.

For the time being, experts far more qualifies than our COP-GS power generation project are helping to bring unmanageable debt under control.

^^ Full Martin Lewis Article: Click Here ^^

^^ Full Martin Lewis Article: Click Here ^^

***********

Further details from Scotslion Ltd:-

Click Here

***********

To find these pages again in a vast jungle of internet, just use the acronym…

COPGS

Short for…

Community Owned Power Generator Station.

A quick search on Google, or your preferred search-engine of the COPGS acronym will get you safely back to this website and the project to halve your energy bills.

***********

To Return To The Frontpage: