For Reference & Research

Regenerating The High Street

Making Good On A Bad Bank

For the multitude of times many of us have heard a bank manager say: “No, that won’t work”. Or: “We won’t be able to help you”. This next building we bought is a fair rejoinder to the often depressing response from banks and their managers. However you might look at this experience, 4 friends turned £12,000 into £22,137 net (each). Plus three jobs were created. Literally four bank customers showing how a bank manager’s failure can result in the doubling of these four friends’ funds. £48,000 went in and £96,000 came out. It felt like legalised bank robbery. Only this time the customers won, and it was absolutely legal. How? Why?

The High Street does not need to die.

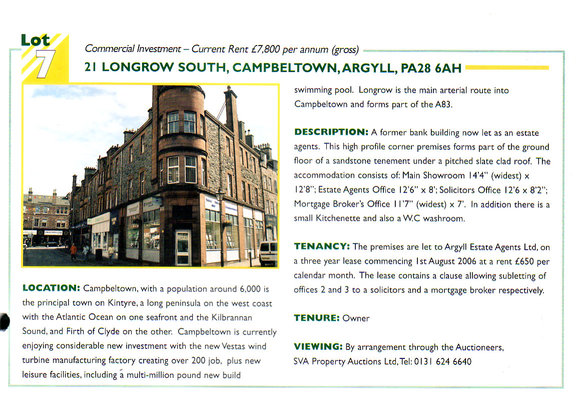

^^ Big Old Bank Building ^^

^^ Bought By 4 Friends ^^

Ground Floor Either Side of The Apex Doorway

This former Bank of Scotland building pictured immediately above and below had stood empty for 5 years and was typical of High Street anywhere in the UK. This empty eyesore was one from Argyll.

=> The purchase/sale numbers and results may seem incredulous; which is why we have included the TITLE-DEEDS and HM Land Registry documents to prove the High Street can be saved.

If we can do this, we would encourage others to do so too. The renovation is now a standardised process for Argyll Group Private Equity (formerly Argyll Group plc).

=> In the 35 years between 1989 to 2024 we have bought + renovated + leased and mentored tenants + sold a total of 84 closed-shops and dilapidated factories + shut~hotels.

A promised, we illustrate of the commercial premises bought by our group of friends and herewith include the Title-Deeds to prove that the High Street can be saved from derelict eyesores. This corner property reminded us of the iconic “Flatiron” building in north America (here). This former bank is a lot smaller, it is still a handsome sandstone structure. Located at 21 Longrow South, and the side building at 12 Union Street. One part could have been an internet based business and the other a home.

^^ The Old Bank ^^

21 Longrow South

Very Prominent Shop Windows

This venture happened because a friend wanted to buy ruinous water mill at the nearby Mull of Kintyre for £20,000. He had made an offer and it was accepted.

=> Our friend had £12,000 in his savings account. So he asked the bank to go 50% loan-to-value with the old watermill as collateral for the bank.

A £20,000 building as security for a £10,000 loan. At first the bank said yes. Then came a review at HQ of general lending criteria. The bank changed their mind and resiled, stating: “that renovation project is not something we are interest in any longer, so we won’t be supporting you”. Our friend was besides himself with frustration. He had a significant amount of cash to put into the unique old mill building. He also had a very well paying job to support this secured loan. Added to which, there was a good chunk of equity in his own house. On paper the deal to buy the old water mill was solid and should have gone ahead.

We got speaking about this sad state of affairs and the loss of his ideal home project – the watermill building. Ironically, the conversation was held outside our friend’s Bank of Scotland branch in this photo.

=> The Bank of Scotland closed down the bank in the picture at the top of this page is was deemed “too big”.

The unreliable bank manager had lost his landmark sandstone bank and the Bank of Scotland had been rehoused in converted undertakers building 60 yards along from this decent looking building.

In a twist of fate, we both turned to look at the empty premises. Out of frustration and a growing sense of disgust from years of discreditable behaviour by the banking industry…

I suggested a small bet. We should buy the old bank building and show the manager that my friend didn’t need to borrow money from this disreputable institution to realise his dreams. There was another way to fund his unique property owning ambitions.

This was our lateral thought way of making a point. Banks are not bastions of financial excellence that the glossy television adverts extol. Of course there are good bank managers, but all too rare. There was a way we could help a friend raise the £20,000 he needed, and it could be done without a bank loan.

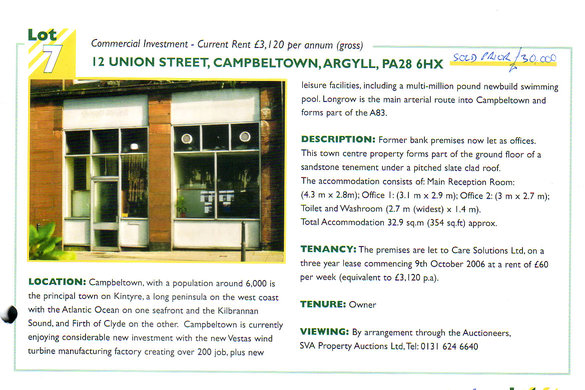

The Old Bank – 12 Union Street Elevation

All 8 glass window segments included in the ownership of this building and show the relatively large size of the property

Out of a chance meeting and conversation aimed at putting the world to rights my friend-without-a-watermill and I hatched a plan to manage a legal bank heist. That is pretty much what happened. Well we didn’t exactly rob a bank. But our modest sized property adventure doubled our money.

Our friend, who had been rejected by his bank, joined us and then managed to extract the £10,000 he needed from the bank. Legally. But not in the form of a loan or mortgage. It was pure profit. An honest bank job! We enjoyed the delicious irony. The friend near enough doubled his money by buying a quarter of this bank building. He won. We won.

=> Just in case you are scratching your head wondering whether this is a real life (legal) bank heist, or a tall tale, we attach the title-deeds below!

Please don’t feel sorry for the banks. They are akin to the oldest crooks in the world. If you leave your savings in with these dubious banks, they begrudgingly give 2% a year in interest.

=> Then these bankers lend out our money to folk at 29% APR, whilst paying their savers (all of us) a meagre 2% in interest.

=> Rhetorical question: Who gets the 27% difference in funds?

This page narrates just four friends withdrawing a relatively small portion of our savings to buy a building. It was (an every one since is) an asset-backed property, fully insured and with no mortgage. A pretty solid asset. For sure, after the 2007 financial crisis, having money in bricks and mortar rather than in old paper notes with pictures of the greedy banks on them is something that our readers might like to reflect upon?

=> The Title-Deeds and ownership transfer documents lower down this page are what many folk do NOT get to see.

It is the business-end of what conveyancing solicitors do and how buildings are conveyed from one owner to another owner, along with a glimpse at the workings of HM Land Registry.

^^ Interior of The Old Bank ^^

Prior To Refurbishment

***********

^^ Interior of The Old Bank ^^

After Refurbishment

What happened next?

The bank no longer had our funds in their safe to lend out at quasi Wonga dodgy money-lender rates (here) whilst giving us each a paltry 2% interest on our cash. They lost us as customers. They lost a huge profit on their former bank branch. They lost our friend’s business. They lost. Period.

Moral of This Purchase?

If you can possibly manage to buy a property without a bank mortgage, then seriously consider doing it that way. Some banks help customers, but many are less use than the proverbial chocolate teapot. If you seek to buy a unique property such as an old watermill, be prepared for knock-backs from the banking industry. Better still look at buying your old coastguard station or water tower, windmill, island or church with pooled funds from a trusted group of friends and family. But please consider making best efforts to avoid any mortgage. From our experience, 100% equity is the way to go.

For anyone who doubts the veracity of the profits in this case, study the official results and supporting Land Registry documentation below, you will see …

Gross Profit: £48,000

Net profit: £40,542.71

Solicitors costs plus auction fees, planning, renovation etc: £7,457.29

The four friends popped £12,000 each into the property-club solicitors and were astounded that owning this old bank would mean after 141 days was a…

Resale Total of: £96,000

After deduction of costs...

Total payable to each member:

£22,135.67

That equates to a net profit of £10,135.67 for each member of our bank renovation + re-opening project. This was one of the last High Street shop/office renovation projects we ran, prior to going relatively dormant during the global financial crisis (yet another banking industry disaster from which we all suffer).

Please note, for the sake of good form we MUST advise that the profits (documentary proof below) are NOT guaranteed. If you do embark on this type of project, you can make a loss or profit. If in doubt, please take independent financial advice.

The majority of more formal Argyll Group Private Equity (Argyll Group plc) members are content with a 10% to 15% return when averaged out over the various projects.

All building purchases are asset backed and on a 100% equity basis. So worst case scenario, we are “stuck” with a piece of land or building that will, in most situations, retain a core value that cannot be extinguished.

This page and Title-Deed statements cover:-

The Old Bank, 21 Longrow South Campbeltown, Argyll, PA28 6AH.

The Old Bank, 12 Union Street, Campbeltown, Argyll, PA28 6HX.

Google 3D Interactive Streetview: Click Here

*******

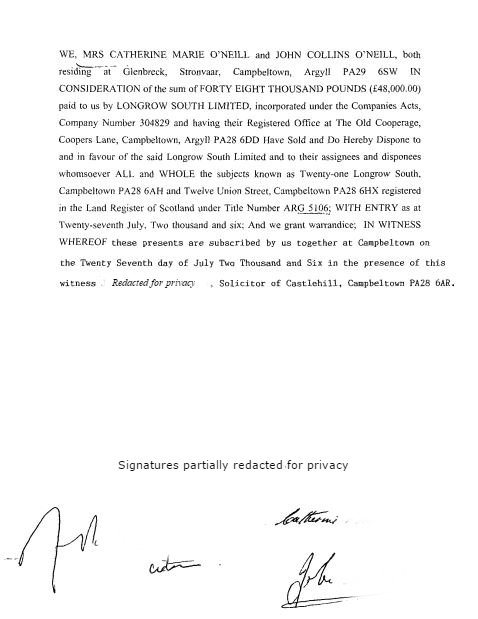

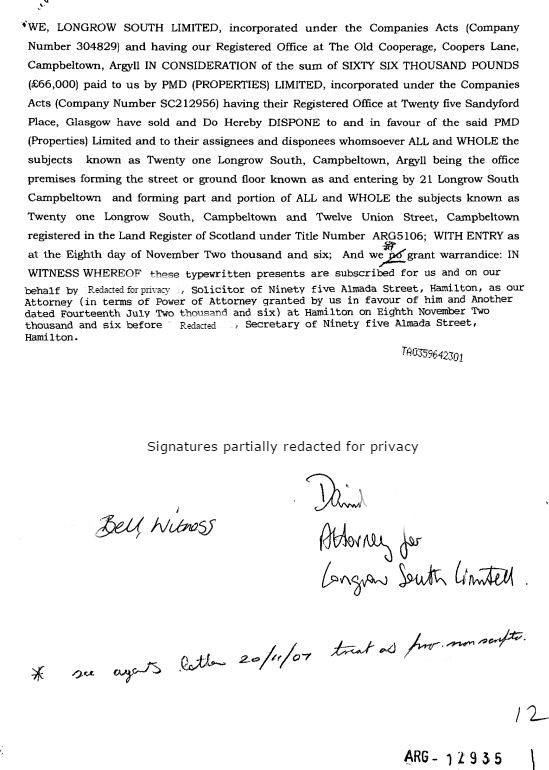

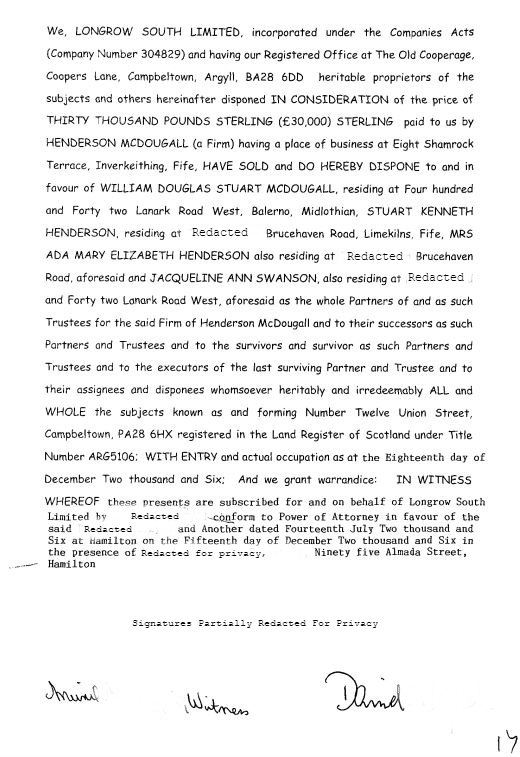

Deeds & HM Land Registry Proofs

Purchase by our single project ring-fenced entity…

“Longrow South Ltd”

Bought for £48,000 on 27th July 2006

Title split into two buildings. After refurbishment the first was sold for £66,000 on 8th November 2006. “Longrow South Ltd” owned this for 104 days: click here.

The second building from this title was sold for £30,000 on 15th December 2006. “Longrow South Ltd” owned this for 141 days: click here.

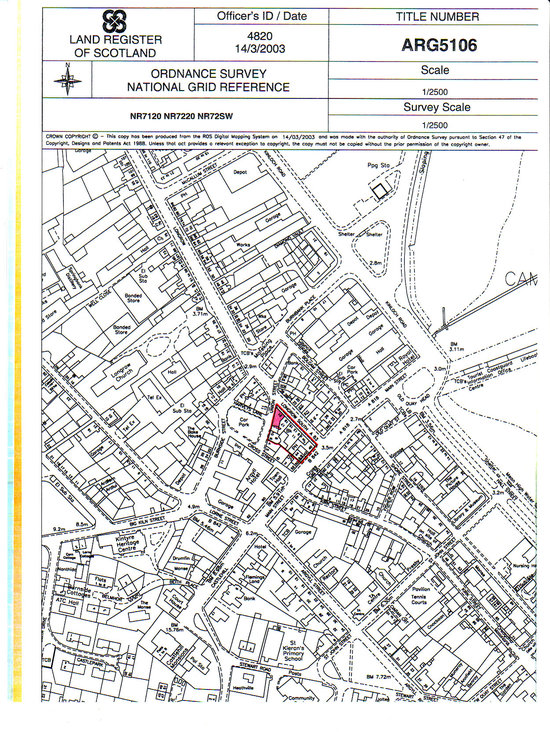

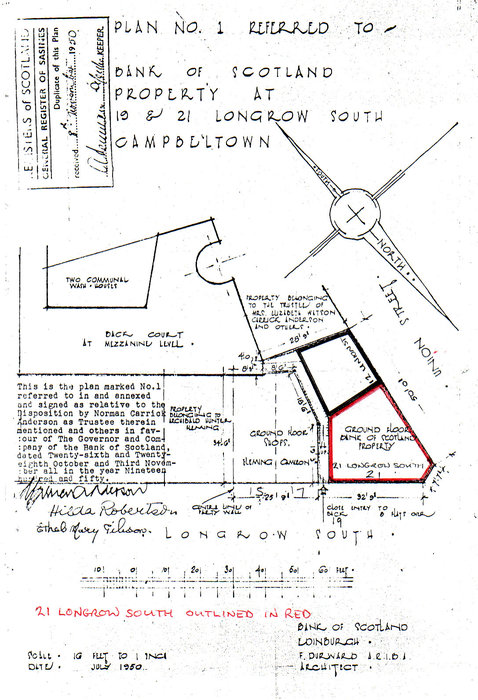

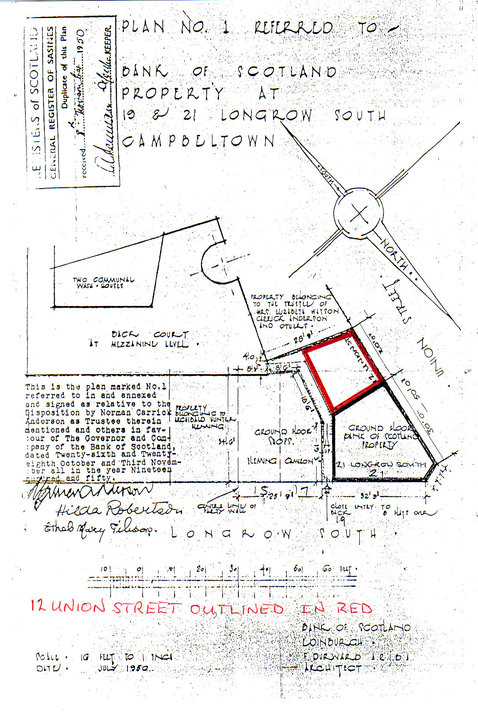

HM Land Registry Title Plan…

HM Land Registry Deed

Evidencing purchase by “Longrow South Ltd” at £48,000

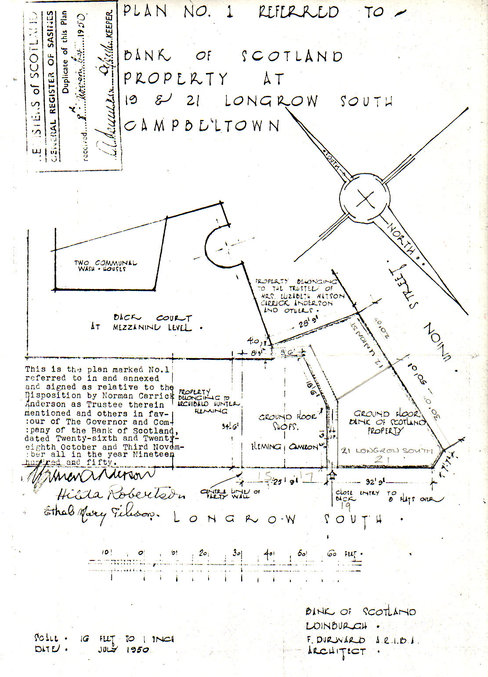

This bank that we had bought was then split the former bank premises into two – distilling 21 Longrow South and 12 Union Street into separate titles. Here is a copy of the earlier Deed Title Plan drawing from 1950 showing the two buildings as one unit…

The first of the two buildings from this one title was sold after being refurbished on 8th November 2006. This was via SVA Auctions (held on 11 October 2006 – 28 days between auction and payment/entry). Here is a copy of the auction catalogue excerpt…

HM Land Registry Deed

Evidencing sale of 21 Longrow South by our holding company “Longrow South Ltd” for £66,000…

Here is the Title-Deed documentation outlining the building section at 21 Longrow South in red…

The second of the two buildings from this one title was sold after being refurbished on 15th December 2006. This was via SVA Auctions (held on 29th November 2006). Here is a copy of the auction catalogue excerpt…

HM Land Registry Deed

Here is the Title-Deed documentation outlining the building evidencing sale of 12 Union Street by “Longrow South Ltd” for £30,000…

Here is the deed documentation outlining the building section at 21 Union Street in red…

*******

Costs

Solicitor Conveyance: Inbound/Outbound + Auction Attendance: £881.25

Auction House & Related Legal Attendance Fees: £926.88

Planning + Publicity + Stamps & All Other Costs: £424.62

Refurbishment Costs For 21 Longrow South and 12 Union Street: £5,224.54

Total Costs For This Project: £7457.29

*******

Fortunately we are still a fairly small group with just 203 members (2022 stats: 585 members of whom 111 are particularly active shareholders)- so it is possible to keep on top of the email questions that are asked.

If you do have something to ask about this bank adventure, or indeed any point that arises from our Argyll Group website, please click here to get in touch and we shall make best efforts to answer. Thanks.

Purchase Price For Building: £48,000.

Resale: £96,000. Gross Profit: £48,000.

Net Profit: £40,542

Our property-club owned this for 141 days: (here) £287 profit from a bank each day!