YOU MAY NEED TO SCROLL DOWN THIS PAGE

TO FIND THE PROPERTY THAT YOU ARE LOOKING FOR...

Welcome to the Scotslion Ltd. , (previously a division of Argyll Group plc). We are the project-management division of the earlier plc (public limited company).

There are four main elements:-

1]. Publishing the Unique Property Bulletin.

2]. Unique Property ~ Renovation of Actual Buildings.

3]. The High Street Rescue Initiative, and;

4]. Charity Projects such as the the Creditcare Money Advice charity and the Friends of TS Queen Mary charity.

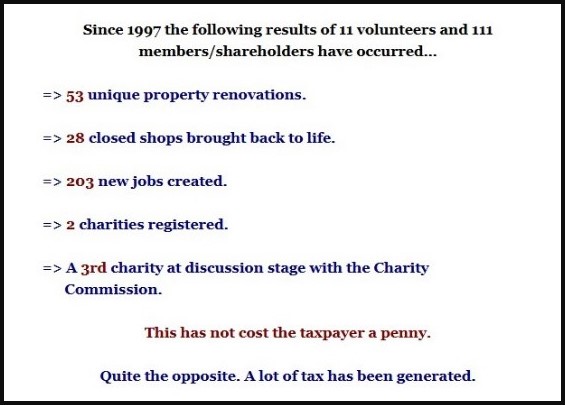

To date…

Examples include properties that are actually for sale, or completed and retained within the portfolio of each company or not-for-profit organisation, or charity we assist.

***********

|

|

|

|

|

|

\/

1]. Unique Property Bulletin

Social Media: Blog

Helping unique people to find unique homes…

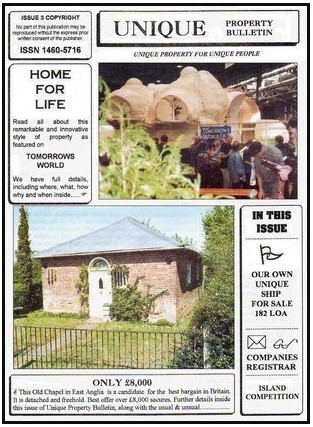

An example of what we mean by “accidental success” is our old paper version of unique Property Bulletin,…

^^ Unique Property Bulletin ~ A4 Paper Format ^^

^^ First Published In The 1980s ~ Right Up To 2010 ^^

^^ Circulation Via Royal Main Post ^^

1,100 to 3,282 Per Month (1980s)

Then a very good friend taught our old Dino-Sore-Russ editor how to work an internet site. The results were startling. Unique Property Bulletin went online at 7th February 2011 (here).

Subsequently, just this one national newspaper article resulted in over 10,000 visits to our new Unique Property Bulletin website in one hour. It actually crashed the website…

^^ Online Archived: Click Here (Original: Here) ^^

The website bandwidth was increased drastically to cope with larger visitor numbers to avoid crashing from an overload again.

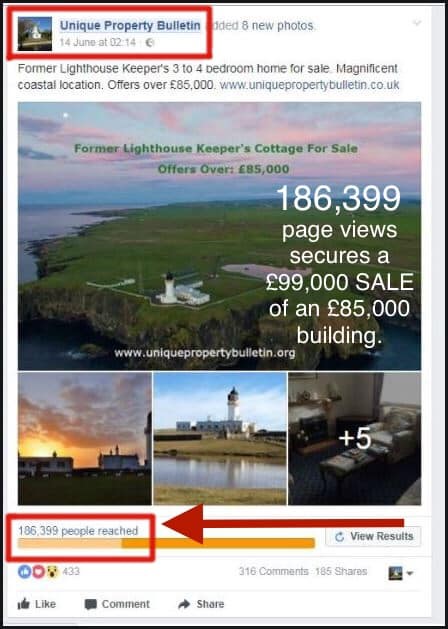

This was just as well, because the next shock for an obscure hobby website of Unique Property Bulletin ws when something goes a bit viral on the internet. This happens.

186,399 Page Views!

None Too Shabby From 1,100 Paper Circulation.

High Numbers May Seem Good

But The Infrastructure To Answer

A Ton of Phone Calls Had To Be Upgraded To Cope!

Hence the purchase of an old Swinton insurance building and renovation to cope. Two offices for the websites and the remaining spare offices to help our “High Street Rescue” project: click here.

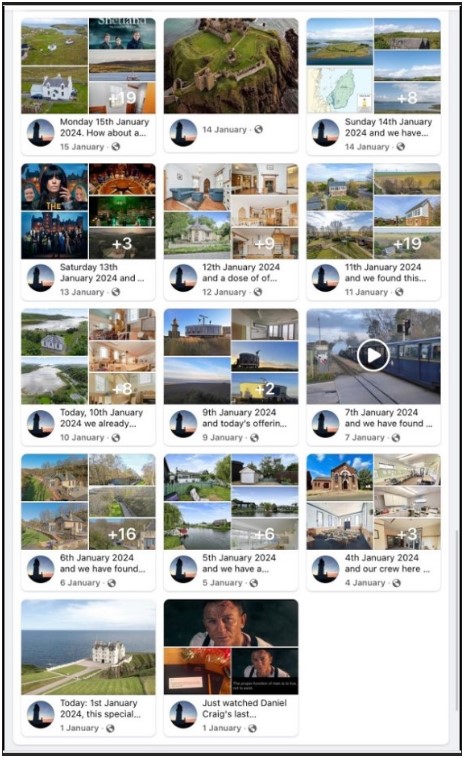

This is how we are growing the websites to help you in as best a way we can. The aim is for daily updates with as tempting a series of unique property sales as we can manage.

Example of Our Daily Targets Online

A Free Service For You Since 1985

Social Media: Blog

Helping unique people to find unique homes…

Unique Property Bulletin Online: Click Here

***********

Editor’s Webpage: Click Here.

***********

|

|

|

|

|

|

\/

2]. Unique Property ~Renovation of Buildings

This example is a little ironic as due to the managing diretor being hit on the head by a big ship and almost carking it (full disclosure as per here)

Unique Property ~ Renovation of Actual Buildings.

The founder of Unique Property Bulletin ~ Russ McLean (click here) is retiring in 2025 (well partial retirement) and whilst he will still be directing the Unique Property Bulletin Ltd (here), this company, Scotslion Ltd., will soon be managed by David Rutherford.

David was with Argyll Group plc., and as that progressed he became a director of Scotslion Ltd., on 2nd May 2013 (here).

***********

With respect to Tod Head Lighthouse Station (tower NOT included) we had looked at renting out the lighthouse keepers’ dwellings. But now hit by retirement age, Russ has been advised to cut down the workload. Unfortunately, his ability to manage rentals has passed.

So the last remaining lighthouse home is now…

For Sale

Flat-3

Guide: £105,780, “as is”.

Or £111,000 with the basic renovation work completed.

^^ Flat-3 At Tod Head Lighthouse Station ^^

^^ The View From Flat-3 Balcony ^^

The Lighthouse Tower Is Not Included In This Sale.

Flat-3 Has Views From All Three Sides.

^^ Flat-3 At Tod Head Lighthouse Station ^^

^^ Kinneff By Montrose, DD10 0TH ^^

Guide: £105,780 “as is”

The Tower Is Not Included.

Further details will appear soon on the social media feeds of…

The Unique Property Bulletin

Click Here

Maybe subscribe to the social media feed so you don’t miss out!

***********

|

|

\/

Example of Our Previous

Lighthouse Station Renovations

At Noss Head Lighthouse Station

^^ Our Previous Lighthouse Station ^^

The photo directly above this paragraph was taken before the 23rd May 2017. That is pretty much the condition in which we bought Noss Head Lighthouse Station.

After a lot of money was happily spent on this far northern sanctuary of a lighthouse station at Noss Head overlooking the Orcadian archipelago, here is what the previous lighthouse station was transformed into…

^^ Our Previous Lighthouse Station ^^

Sadly the 10-hour round-trip north is now too much for our retiring managing director due to injury and spinal surgery starting way back (here) and more disc-drilling by the medics scheduled soon. This is the reason that our Noss Head Lighthouse Station was put up for sale and the move hundreds of miles south to be nearer to family in Carnoustie with just a one hour drive between close relatives.

A bit frustrating, as a lot of time, love and effort had gone into ensuring the Noss Head Lighthouse Station in the far north had a once-in-thirty-year renovation just completed…

^^ Noss Head Lighthouse Station ^^

Main Building: Professionally Being Made Watertight ^^

^^ Noss Head Lighthouse Station ^^

Roof & Chimney Maintenance Never End

The specialist roof/chimney covering has a temporary repair as the manufacturer of the RNLI type sponson roof material arranges for their team to attend.

^^ Noss Head Lighthouse Station ^^

Thankfully, this work cured all the leaks and water ingress below until the manufacturer of the roof covering could have their crew onsite.

^^ Noss Head Lighthouse Station: Main House ^^

A last check from the top of the lighthouse tower with binoculars to see if there were any obvious points of water ingress still unattended. When we bought Noss Head Lighthouse Station on 23rd May 2017, there was considerable water damage inside the main building.

Next was the preparation of the elevation surfaces.

Fortunately, the Northern Lighthouse Board were renovating their tower…

^^ Noss Head Lighthouse Station Tower ^^

^^ Still Owned & Maintained By The Northern Lighthouse Board ^^

We say “fortunately” the Northern Lighthouse Board (NLB) were renovating their tower as the employee were resident in our accommodation block plus a site office we had outfitted for the NLB in the old Engine House nearby as the NLB were incredibly kind in arranging a “Trade Only Account” for us to buy the specific (Forth Rail Bridge type) specialist paint system that the NLB apply to their lighthouse towers…

^^ Liquefied Gold (White Paint) At An Affordable Price ^^

This Is The Specialist Paint Actually Used By

The Northern Lighthouse Board

To Paint Their Lighthouse Towers

We have been given permission to buy this paint for other lighthouse building owners. Just get in touch with us and we will help if at all possible: click here.

Having the right paint and professional team members to do the job made a huge difference.

Though the first job, seeing as this is a Grade A listed building was to remove the satellite television dish and the ham-radio transmitter aerial, along with some lighting that had a provenance as recycled lights acquired from the M6 motorway renovation!

^^ A Good 75% of The Repaint Was Preparation ^^

Though, seeing the finished repaint filled our hearts to the brim. The old lighthouse buildings were coming back to life..

^^ Noss Head Lighthouse Station Professionally Repainted ^^

When observed close-up, the process and transformation is remarkable…

^^ Noss Head Lighthouse Station; Main Accommodation Block ^^

A couple of “before” and “after” photographs from 2017.

^^ Noss Head Lighthouse Station: Main Accommodation Block ^^

The outside was very satisfactory to complete that phase of the renovation.

The inside was next…

^^ Noss Head Lighthouse Station: Main Living Room ^^

The inside, being Grade A listed could not be readily altered.

Though our professional architectural and listed building advice was that the vandalised 1995 materials could be replaced and this afforded an opportunity to insulate some parts of the (1995-1999 repairs) of the building that were not part of the original 1849 structure. This building had been completely derelict in the 1990s and the vandalism very distressing, both to the building and anyone who cares about lighthouses.

^^ Noss Head Lighthouse Station: Now Back To Life ^^

Crucially, the fact this building is now fully renovated and now habitable means that there is a budget to properly maintain it.

^^ Noss Head Lighthouse Station: Main Block Floorplan ^^

Copyright: Scotslion Ltd.

^^ Noss Head Lighthouse Station: Perspective From Above ^^

By Kind Permission of Oracle Drone Services

***********

It was a difficult choice to leave the far northern lighthouse home at Noss Head Lighthouse Station. But with family able to visit the more southerly Tod Head Lighthouse Station within a 1-hour drive, life is much better now. Plus we have the prospect of some new neighbours who might like to consider purchasing the adjacent (former) lighthouse keeper’s home: flat number-3. Maybe you?

Here is a short video to give an idea of the picturesque location at Tod Head Lighthouse Station…

^^ Click This Video To Watch Tod Head Location ^^

Tod Head Lighthouse Station is just over 1 hour from Dundee Airport (here), with flights to Edinburgh, Glasgow, Manchester, Yorkshire, London and wide selection of national and international airports and destinations (click here).

^^ Flat-3, Tod Head Lighthouse Station ^^

Guide: £111,000

Discounted To:

£105,780.

Full details will be posted soon (once the EPC report is available).

Keep an eye on our group social media feed…

Click Here

***********

|

\/

2]. The High Street Rescue Initiative

One of our favourites from the High Street Rescue Initiative was when our group of friends bought the worst pub in town…

A Closed-Down Boarded-Up Derelict Shell

This also includes buildings such as “the last village shop”” as per the planning permission granted for one of our larger projects…

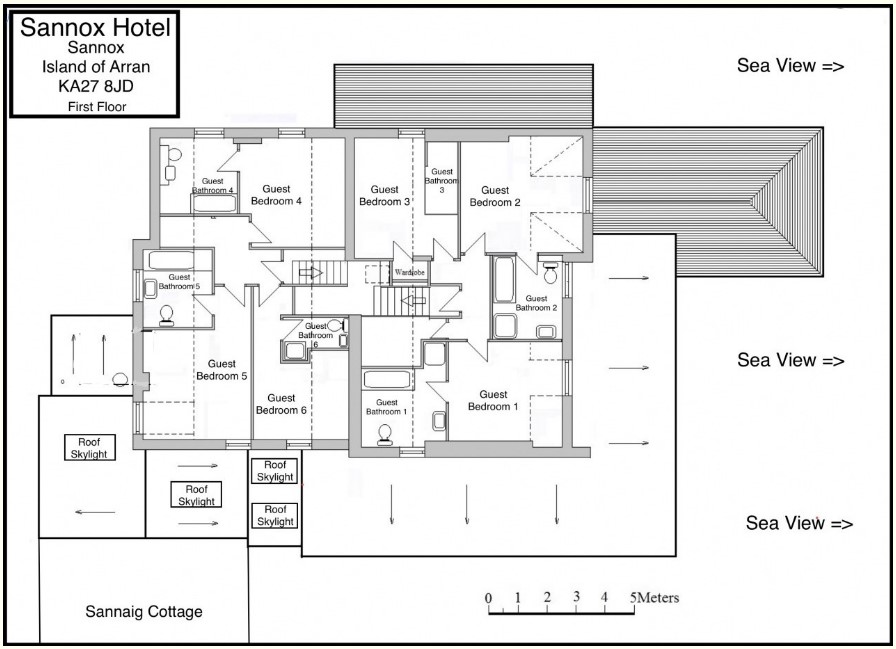

Sannox Hotel, Island of Arran

Guide: £395,000.

This is an opportunity for someone who wishes to change their lifestyle to an amazing island-based home + business + passive income if desired.

We have the Sannox Hotel for sale. However, rather than stick a price that equates to what we spent on the building in renovations cost and newbuild construction, we have brought the entry-level of the core Sannox Hotel building down from £795,000 (for all three elements: hotel + shop + house) to a more affordable £395,000 for the renovated hotel element.

^^ Sannox Hotel + Shop + Newbuild House ^^

Was £795,000 For House + Hotel + Village Shop.

Now The Core Hotel & Owner’s Flat Is Just £395,000.

The two additional elements (new village shop and newbuild holiday apartment) will be retained by ourselves pending the new owners of the hotel either leasing these newbuild apartment and newbuild village shop, or just taking an “option” to purchase them at a future date when the new Sannox Hotel owners have built up their reserves.

^^ Sannox Hotel, Isle of Arran, KA27 8JD ^^

To get in touch for viewings + questions : Click here.

Our directors bought the old, closed Sannox Hotel before the Covid pandemic and managed to have a substantial Planning Application for the following back-to-bricks renovation and the following improvements…

To date, approximately £795,000 has been spent on the actual building and the renovations.

=> These renovations are approximately 90% complete.

Unfortunately, our managing director had spinal surgery following an accident in an earlier career (here). Within the next few months from May 2024, a second and third spinal operation have been advised. This would delay the completion and re-opening of the Sannox Hotel.

=> It would be unfair on the local community to have a main amenity in the village, including a new village shop further delay.

=> Yes it has taken EIGHT YEARS for the new MV Glen Sannox Ferry to be built (click here), but the new owner of Sannox Hotel will be very lucky with timing as there are SIX NEW FERRIES on their way to the CalMac ferry network (click here).

=> So with this problem of new ferries being held up, now with a solution in sight, we do not want the local hotel facilities at Sannox, nor the new village shop held up any further. The director that has progressed the Sannox Hotel project this far now requires further spinal surgery. That would slow the re-opening by another 12 months due recovery and physio etc.

=> Far better to think laterally and find a way to get the Sannox Hotel re-opened this year, 2024. Hence this title-split purchase option with the core hotel (and owner’s flat) being sold first at offers over: £395,000. Then an option to lease or purchase the Bay Cottage newbuild house and/or an option to lease/purchase the new Village Shop. It makes a substantial opportunity available to many more folk at a far more affordable £395,000 than a large bite of £795,000! Albeit that amount reflected a back-to-bricks rebuild + two newbuilds.

Fortunately, there is no mortgage on the hotel, and it has been the business of our parent company to help closed down shops, factories and tired High Streets to reopen. Firstly by renovation and then through helping new businesses become established in the refurbished buildings. Including helping folk financially and with advice to start up businesses in the style of Dragons’ Den.

Sannox Hotel: 3 Segments

Either £795,000 For All 3 Parts.

Or £395,000 For The Renovated Hotel.

Sannox Hotel: 3 Segments

Either £795,000 For All 3 Parts.

Or £395,000 For The Renovated Hotel.

Consequently, we are able to make the Sannox Hotel a lot more affordable to the person or couple who would like this new and fairly unique style of life and employment. The proverbial picture paints a thousand words. How would you feel about living and working here, in this picture at Sannox Bay on the Island of Arran?

Returning to this Sannox Hotel building for sale, here is the front garden…

^^ Sannox Hotel Front Garden ^^

Alfresco Coffee & Snacks + View

Here is a short, but good quality video of the extended “front garden” at Sannox Hotel….

^^ Sannox Hotel + Sannox Beach + Sannox Bay

Courtesy of MadMacs FPV

MadMacs We Would Like

To Say Thankyou Properly: (Here)

If the Sannox Hotel does not sell, we have a policy of re-opening the buildings that have been renovated and either leasing them to ensure return to operational/amenity us, or we employ a manager and staff to runf the hotel (or shop, or office or factory, depending upon which project we have been assigned.

With Sannox Hotel, because the owner grew up in the adjacent village of Corrie at Blackrock House Hotel, he understood how important it is to provide amenities, Back in the 1980s at Corrie, the provision of small boat hire from Corrie Port…

^^ Corrie Port (c) Russ McLean ^^

Negotiations to buy back a ship that Russ McLean purchased from CalMac ferries and sold to the small Island of Aran off of the west coast of Ireland.

The ship is now in Reykjavík and negotiations are ongoing for this vessel and other similar sized ships to augment the Sannox Hotel facilities. Re-opening is hoped to occur mid-2025. Specifically as the newbuild ferry, MV Glen Sannox started on the Arran mainland to Brodick service on 12th January 2025.

With respect to smaller vessel size for Sannox Hotel sea tours, when this priniple was applied to Blackrock House Hotel in Corrie during the 1980s, it increased hotel occupancy by 18% at that time ad helped make the business much more viable.

So with respect to Sannox Hotel in 2025, there is a likelihood of a new sea tour (and backup ferry service) based initially at Sannox Hotel and using a ship we bought off of CalMac in 2001 (the MV Lochmor). That vessel has had a major rebuild. Discussions with the current owners of the ship in Iceland are commercially sensitive.

^^ The Sannox Hotel Renovation ^^

Includes A Hotel-Based Ship Tour Facility.

We are hoping the MV Lochmor (here) buy-back concludes. Though the owner of Sannox Hotel has spinal surgery due imminently. Hence one option is to sell the Sannox Hotel to a younger fitter person or couple.

^^ MV Lochmor After The Major Refit ^^

By the look of the chief + the skipper and mate, driving MV Lochmor to the insurance limits of ply off Davaar Island twice a week was more fun than work…

^^ MV Lochmor On A Regular “Engine Run” ^^

Ships often degrade if left tied up and only minimally maintained (if at all).

So partly due to the health of MV Lochmor, we ensured the ferry had all systems + engines + generators run up, twice a week. All under the careful supervision of the most important component in and ship: the chief engineer.

MV Lochmor Main Engines ^^

In this case we were incredibly fortunate to have Chief Engineer Donnie Woodrow in charge of the engineering (it was Donnie who was the Chief aboard MV Pentalina (here) on the inaugural voyage from the builders yard in the Philippines to the ferry’s home port of St Margaret’s Hope on Orkney.

=> Without MV Pentalina, then M Alfred would not have been built and the island of Arran would be in a very poor state!

^^ MV Lochmor In 2001 Before The Refit ^^

After the refit, the MV Lochmor has very comfortable internal seating and makes an ideal vessel for coastal cruising around Arran and the smaller isles.

^^ MV Lochmor After The Major Refit ^^

^^ MV Lochmor After The Major Refit ^^

To avoid missing out on news and updates, please complete that pop-up box or text us your email address: click here.

Until Then, For Viewing Arrangements, Please Get In Touch:

***********

|

\/

3]. Charity Projects

Creditcare Money Advice Charity

This charity was registered and established following the death of a friend of Russ McLean when Russ had moved from Scotland to work in London for a few years.

Terry had taken his own life whilst worried about debt.

Rather than some warm words to Terry’s widow and two young children, we thought it would be reasonable to make an effort provide help to prevent further tragedies.

We managed 10 years and then, sadly due to PTSD issues from Russ McLean’s previous career (click here and credentials: here), plus an improvement in major resources made available for the traditional charities such as CAB, the trustees of the Creditcare Money Advice Charity brought it to an orderly close.

Some 3,300 folk had been helped and the trustees felt that was a fair way to honour the memory of our friend Terry.

^^ 10 Years of Creditcare Money Advice Charity ^^

In amongst the tragedy, there were some moments of what might be termed “dark humour.” Knowing Terry, we believe he would have approved of this article in thee Observer newspaper and a drawing, over which Russ took what is colloquially known in his hometown of Glasgow as a “pure reddy” (translation: here).

^^ Creditcare Money Advice Charity ^^

Albeit, we closed this Money Advice Charity 18 years ago, the training an understanding gained, along with the engineering aspects of the next charity registered from our office in Alyth, Blairgowrie mean that “money plus engineering” are excellent foundations for the third in this triumvirate of charity endeavours.

But we should, perhaps indicate details of the second charity constituted + written + registered from this old dinosaur of a computer keyboard…

***********

Friend of TS Queen Mary Charity

Whilst two friends started this charity – and it took more than two years to get almost a year to get the protocols in place, Russ McLean has asked that it be made abundantly clear as from 2012

.

.

***********

|

|

\/

Lots More

Please Check Back Regularly.

Or Subscribe For Email Alerts

In The Annoying Pop-Up Box!

We have launched this dedicated Unique Property For Sale page with the aim of narrating how the publication got started: by a modest Old Lookout building on Davaar Island that we leased for…

£5 Per Year

On Davaar Island

(no longer available, but this type of rental does happen)

(we are happy to show you the how, where and when).

The deal for the Old Lookout building was at £5- per year in exchange for an agreement that we would renovate that building. That took 9 months and gave us 9 years of sublime time on an awesome island…

.^^ The Old Lookout Station Before Renovation ^^

.^^ The Old Lookout Station After Renovation ^^

.

.^^ The Old Lookout Station Before Renovation ^^

.^^ The Old Lookout Station Before Renovation ^^

.

^^ Even Though We Vacated ^^

& Parted Company With Our

Old Coastguard Building In 1995

You Can Rent It From The New Owners!

The location of that Old Lookout Coastguard building was the picture-postcard perfect Davaar Island in Argyll. You either went across pier-to-pier in a boat, or twice a day you could walk across at low tide…

^^ Davaar Island, Argyll ^^

^^ Birthplace Of Unique Property Bulletin ^ ^

Photo Attribution Simon Butterworth ~ Alamy Fee Has Been Paid

In 1997 we started buying some of the buildings featured in our Unique Property Bulletin where it was evident they needed renovating! Now, 28 years later, in 2025 we are moving one of our offices to a lighthouse station. As luck would have it, we have two “spare parts” which we always offer first to our loyal readers as featured above.

=> So that you do not miss any other goodies that come up for sale direct from Unique Property Bulletin, perhaps you might like to subscribe to this page, or even “follow” our social media account…